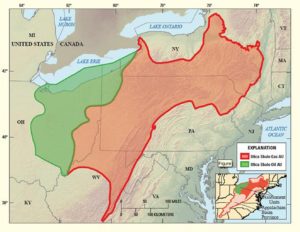

For many people, the notion of drilling for oil brings up images of endless fields filled as far as the eye can see with sky-high oil wells and pumps churning out that black-tar Texas gold. Though getting rich drilling for oil may bring up images of Dallas and J.R. Ewing for many, today’s oil and gas sector involves a very different picture. In recent years it is shale oil and gas excavation via fracking and horizontally drilling that is making headlines. Though familiar locations such as Midland, Texas remain important in this new energy sector boom, previously unheard of locations such as Tuscarawas County, Ohio and Lycoming County, Pennsylvania have become key spots for shale oil drilling and fracking.

So when we say oil and gas boom, how much are we talking about? According to CNN Money, the International Energy Agency believes that the U.S. will produce more than 11 million barrels of oil and natural gas by the second half of 2014. To give perspective on how much this is, such production levels would make the U.S. the largest producer of oil and gas outside of OPEC nations.

Costs Associated with Financing Oil and Gas Projects Are in the Millions

Yet this unprecedented oil boom is not without its own pitfalls. Financing oil and gas projects of this magnitude has proved no easy task. The production process of shale oil requires considerably more work, engineering, science and excavation capabilities than black-tar oil. Shale oil is hidden deep underground between thick layers of thousand-year-old rock, which must be loosened and broken in order to be procured. Hydraulic fracking, as the process is called, is expensive and complex requiring serious oil and gas funding.

Oil and Gas Factoring Provides Project Funding Fast

Though admittedly less complicated than fracking itself, oil and gas financing can also be a challenge as traditional banks can take too long to issue oil and gas loans. As such invoice factoring has become a more popular way of securing financing since it can provide much needed cash quickly without nearly as much paperwork and hassle. Though such oil and gas financing can require a large initial investment, the payoff can be considerable.

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.