Table of Contents

What is manufacturing financing?

Cash flow problems can prevent a manufacturing business from making crucial upgrades to the machinery, buying equipment to stay competitive or hiring the experienced professionals needed to make the business a success. Manufacturing financing can help resolve these issues. Options for getting the capital needed to run a business efficiently include:

Factoring (which is the sale of accounts receivable to a third party), Loans (including manufacturing equipment financing) and SBA loans.

Factoring – also known as invoice factoring or accounts receivable (A/R) factoring—is the sale of pending invoices to a factoring company or a bank at a discount. Invoices can be sold once the goods are delivered to the customer. Discounts range from 1% to 5%, depending on the factor and the industry as well as the number and dollar amount of the invoices. To ensure that the invoices are factorable, it is best to use straightforward billing and avoid tricky-to-monetize arrangements such as progress or contingency billing. To learn more about factoring, please visit our Frequently Asked Questions page or contact us.

How can a business benefit from manufacturing financing?

Manufacturing financing can help your business:

- Expand operations

- Make payroll or hire talent

- Make upgrades

- Invest in marketing and advertising

- Pay suppliers

- Invest in new projects

Factoring—the sale of invoices, or accounts receivable to a factoring company or a bank at a discount—can be used to pay for day-to-day expenses, fund growth or take advantage of bulk discounts. Business Factors offers non-recourse factoring, which means we absorb the loss if invoice is not paid.

Manufacturing loans and manufacturing equipment financing

Loans can be used to purchase equipment or for day-to-day operations.

Manufacturing loans are another way for businesses to get capital to buy new machinery or modernize a fleet of vehicles. Some loans allow a business to take advantage of the Internal Revenue Code (IRS) Section 179 tax break. This tax break permits a business to deduct the entire purchase price of the machinery from its gross income. Loans can be used to purchase equipment or for day-to-day operations. Some loan providers pay the equipment seller directly instead of wiring the funds to the business. Also, some manufacturers provide the financing directly to the business, or they partner with banks to do so. It’s important to read the terms of such agreements to ensure that they do not give the manufacturers undue influence over your business, such as in the case of supply chain financing arrangements.

A lender always wants to know what the proceeds of a loan will be used for. Businesses should be wary of lenders that do not ask about the use of the proceeds (UOP) as such lenders can be predatory.

Loans to purchase equipment or fund day-to-day expenses can be asset-based. This means they are secured by assets, such as machinery, equipment or real estate. They can also rely on revenue or a company’s cash flow as a source of repayment.

The cost of an equipment loan and the kind of loan a business can get vary depending on a business’s financial situation, including its assets, liquidity and track record and time in business.

Please note that any loan is likely to require a collateral filing. This means the lender may ask for something like a blanket lien on the company’s assets (a UCC filing in the U.S. or a PTSA/GSA filing in Canada). A business owner should always pay attention to the fine print to make sure that the collateral that guarantees the loan is proportionate to the amount of the loan. If the value of the items under the lien exceed the amount of the loan, the business can lose valuable assets in the case of default.

Most lenders require that you be in business for at least 6 months to qualify for a loan. If you run a startup but have creditworthy clients, factoring can be a better alternative for your business.

Loans to purchase equipment can be based on the following:

- The business’s revenue or cash flow (revenue- or cash-flow-based loans)

- Its assets, including the equipment itself (asset-based loans)

- Both the business’s revenue and its assets, in a hybrid arrangement

“Hard money” loans are a subtype of asset-based loans that are backed by real estate.

A typical hybrid arrangement is one where a manufacturer gets a receivable-based line of credit or a factoring line at the same time as they get an equipment loan. The equipment loan can be used to:

- Refinance leases

- Pay off anything that is draining cash flow, such as

- Merchant cash advances (MCAs)

- SBA loans

- Microloans

- Tax debt

The idea behind an equipment loan is not only to pay off existing, more expensive debt but also to save a business owner the time and stress associated with managing multiple credit arrangements. Let’s take a look at an example:

- Loan amount: $1,200,000

- Interest rate (all inclusive APR including closing costs): 12.5%, payable quarterly

- Amortization (repayment of the loan principal): 5%, payable quarterly

- Loan term: 10 years

- Collateral: Machinery and equipment

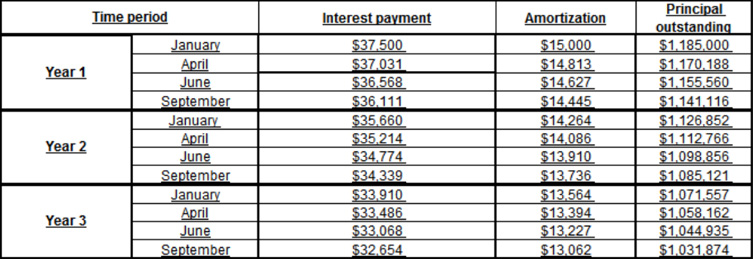

Interest and principal payments, as well as amounts outstanding in the first three years of loan’s life are shown in this chart:

In this example, the interest and amortization amounts paid depend on the outstanding balance of the loan. This balance is reduced as the amortization payments are made.

Let’s assume that the loan is extended in September and begins amortizing in January. The first interest payment will be $37,500, or $1,200,000 times 12.5% paid over four quarters; the first amortization payment will be $15,000, or $1,200,000 times 5% paid over four quarters. These payments are based on the full initial loan balance of $1,200,000.

After these first payments, the remaining balance of the loan is $1,118,500. In April, the interest payment ($37,031) and amortization payment ($14,813) are lower because they are based on this new loan balance.

Since only the amortization payment reduces the loan’s principal, the new loan balance after the April payments is $1,170,188. This balance is the basis for the next round of interest and amortization payments, which are made in June.

Gradually, the loan balance decreases with the amortization payments, and so does the interest payment as it is based on the loan balance. If any balance is left at the end of the 10-year period, it is paid off in one payment at maturity.

The loan pays off an existing loan that encumbered the company’s accounts receivables. Freeing up the receivables allows the company to get a factoring line. Here are the sample terms of the line:

- Line amount: $300,000

- Advance rate: 85%

- Discount rate: 2.19%

- Due date: None. The client uses it for as long as needed.

- Type of arrangement: recourse

In this example, a factor advances 85% of the outstanding invoices, up to $300,000 total. Once an invoice is paid, it is replaced with another one of similar value, or the amount of the line shrinks. The discount rate is only charged on the outstanding invoices (not the full $300,000) and the line does not expire, meaning that the business can use it for as long as it’s needed. Such an arrangement puts the business back in control and allows it to monetize accounts receivable without worrying about collecting on them.

Business Factors & Finance specializes in SBA loans and can help your business prepare a winning application.

SBA Loans

The Small Business Administration (SBA) is an agency of the federal government. It partially guarantees loans that are provided by private lenders. Because of the SBA guarantee, lenders are generally able to offer better terms than they would otherwise. These include competitive terms and counseling and education. SBA loans are available for general business purposes, to fund fixed-asset purchase and for export/import businesses.

These credit facilities can be hard to qualify for, especially if a business does not have any assistance. Reach out to an expert at Business Factors & Finance today to find out if an SBA loan is right for your business and to learn to prepare a winning application. With over 20 years of experience in financial services, Business Factors specializes in SBA loans, as well as revenue-based, working capital and cash flow loans that also can be used to fund manufacturing working capital and equipment purchases.

Read more about SBA Loans here.

Conclusion

In running a manufacturing facility or a machine shop, a company’s success is often dependent on completing projects on time and on meeting and increasing demand. But cash flow problems can make it difficult to take care of some important financial responsibilities. Manufacturing financing helps businesses resolve these issues. The options include factoring—the sale of outstanding invoices at a discount to a third party—as well as manufacturing and SBA loans. Factoring relies primarily upon the credit quality of a business’s customers and can be used at short notice to resolve unexpected cash flow problems. It can also be used to fund growth or pay and retain highly-trained personnel. Factoring can be done on a one-off basis or under a long-term agreement. Business Factors offers businesses the flexibility to choose the best arrangement. Manufacturing loans come in many forms, including revenue-based, cash-flow-based or working capital loans. Loans can be secured directly by equipment, in which case the equipment can be repossessed if there is a default. Loans guaranteed by the SBA are another funding option. These loans may offer competitive terms but have stringent qualification requirements. They may also require a lot of paperwork. Contact Business Factors today for expert help in preparing a winning SBA loan application.

Get Paid Faster

Get a Risk-Free quote from Business Factors for immediate working capital and 24/48 hour invoice factoring