According to the Wall Street Journal, the United States consumes more energy than almost any other country in the world (minus China). Despite efforts to conserve, recycle and reuse resources when we can, we will more than likely remain an energy-consumption nation. Computers, air conditioners, cars, manufacturing facilities, the heating buildings and homes, and more are all modern day conveniences we all enjoy. In fact, our way of life relies on these energy-expending activities.

Millions Needed in Oil and Gas Project Financing

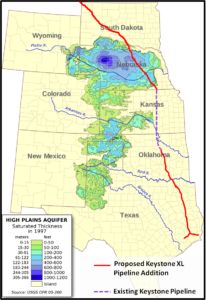

Though it is not without its controversies, one way of securing this oil and gas, factoring in political, environmental, and logistical concerns, is the Keystone XL Pipeline. The proposed undertaking would build a crude oil pipe from Hardisty, Alberta in Canada to Steele City, Nebraska. The massive project would lay down 1,179-miles of pipe across Canada and the U.S. It is estimated to have the capacity to move 830,000 barrels per day.

Installing the pipeline would cost millions in construction funding and would provide much-needed jobs to thousands in the energy sector and in those sectors providing project support, such as construction, transportation and freight factoring.

On January 31, the U.S. State Department released its final assessment, which stated “the project would not substantially worsen carbon pollution.” The report looked at a number of safety and environmental concerns regarding the project as well as its viability. For its construction to begin, President Obama must formally approve the undertaking. Oil and gas project financing will likely start shortly thereafter.

Construction Loan Financing to Come from Banks, Factoring Companies

If approved the Keystone Pipeline project will be one of the largest such undertakings in history requiring millions of dollars in oil and gas funding and construction equipment financing. There are a number of ways to secure such oil and gas financing, including accounts receivable factoring as well as oil and gas loans.

Unlike other options, invoice factoring can provide companies with cash fast so they can ramp up hiring, lease equipment, bolster payroll and more. Financing projects typically includes a fast-moving, peak-and-valley cycle requiring large amounts of cash up front as well as regular cash installments to maintain and support. For these reasons, factoring receivables can be a great option because it can provide cash in both these ways whereas loans more typically provide a lump sum investment at the start of a project.

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.