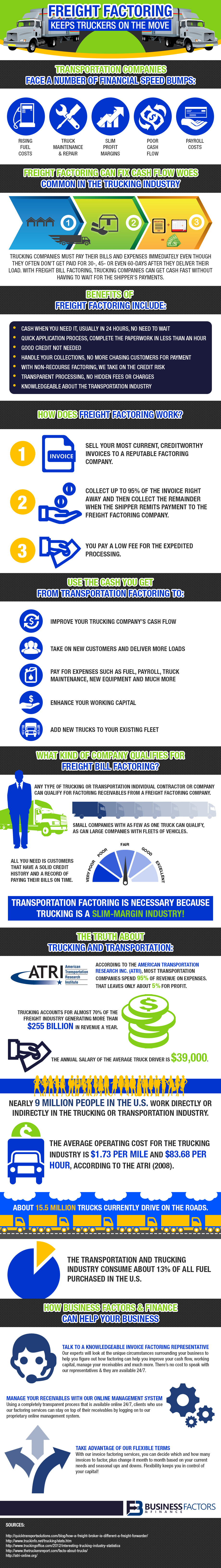

Our latest infographic provides a breakdown of how freight factoring helps trucking companies. Freight factoring provides steady cash flow to cover the many costs related to the transportation industry.

Note: Full graphic transcript and embed code is provided below.

Full Transcript:

Transportation Companies Face a Number of Financial Speed Bumps:

- Rising fuel costs

- Truck maintenance & repair

- Slim profit margins

- Poor cash flow

- Payroll costs

Freight Factoring Can Fix Cash Flow Woes Common in the Trucking Industry

Trucking companies must pay their bills and expenses immediately even though they often don’t get paid for 30-, 45- or even 60-days after they deliver their load. With freight bill factoring, trucking companies can get cash fast without having to wait for the shipper’s payments.

Benefits of Freight Factoring Include:

- Cash when you need it, usually in 24 hours, no need to wait

- Quick application process, complete the paperwork in less than an hour

- Good credit not needed

- Handle your collections, no more chasing customers for payment

- With non-recourse factoring, we take on the credit risk

- Transparent processing, NO hidden fees or charges

- Knowledgeable about the transportation industry

How Does Freight Factoring Work?

Step 1: Sell your most current, creditworthy invoices to a reputable factoring company.

Step 2: Collect up to 95% of the invoice right away and then collect the remainder when the shipper remits payment to the freight factoring company.

Step 3: You pay a low fee for the expedited processing.

Use the Cash You Get From Transportation Factoring to:

- Improve your trucking company’s cash flow

- Take on new customers and deliver more loads

- Pay for expenses such as fuel, payroll, truck maintenance, new equipment and much more

- Enhance your working capital

- Add new trucks to your existing fleet

What Kind of Company Qualifies for Freight Bill Factoring?

- Any type of trucking or transportation individual contractor or company can qualify for factoring receivables from a freight factoring company.

- Small companies with as few as one truck can qualify, as can large companies with fleets of vehicles.

- All you need is customers that have a solid credit history and a record of paying their bills on time.

Transportation Factoring is necessary because trucking is a slim-margin industry!

The Truth about Trucking and Transportation:

- According to the American Transportation Research Inc. (ATRI), most transportation companies spend 95% of revenue on expenses. That leaves only about 5% for profit.

- Trucking accounts for almost 70% of the freight industry generating more than $255 billion in revenue a year.

- The annual salary of the average truck driver is $39,000.

- Nearly 9 million people in the U.S. work directly or indirectly in the trucking or transportation industry.

- The average operating cost for the trucking industry is $1.73 per mile and $83.68 per hour, according to the ATRI (2008).

- About 15.5 million trucks currently drive on the roads.

- The transportation and trucking industry consume about 13% of all fuel purchased in the U.S.

How Business Factors Can Help Your Business

Talk to a Knowledgeable Invoice Factoring Representative

Our experts will look at the unique circumstances surrounding your business to help you figure out how factoring can help you improve your cash flow, working capital, manage your receivables and much more. There’s no cost to speak with our representatives & they are available 24/7.

Manage Your Receivables With Our Online Management System

Using a completely transparent process that is available online 24/7, clients who use our factoring services can stay on top of their receivables by logging on to our proprietary online management system.

Take Advantage of Our Flexible Terms

With our invoice factoring services, you can decide which and how many invoices to factor, plus change it month to month based on your current needs and seasonal ups and downs. Flexibility keeps you in control of your capital!

Sources:http://quicktransportsolutions.com/blog/how-a-freight-broker-is-different-a-freight-forwarder/

http://www.truckinfo.net/trucking/stats.htm

http://www.truckingoffice.com/2012/interesting-trucking-industry-statistics

http://www.thetruckersreport.com/facts-about-trucks/

http://atri-online.org/

Share this Image On Your Site

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.

Since 1991 I specialize in Invoice Factoring, PO financing and ABL facilities. I currently work internationally with companies in the US and Canada via our internet marketing division. Specialties: Accounts Receivable Factoring and Payroll Funding for Manufacturing, Oil & Gas, Telecommunications, Wholesale Trade Distribution, Staffing and Transportation. I always enjoy helping companies rise to the next level of success.